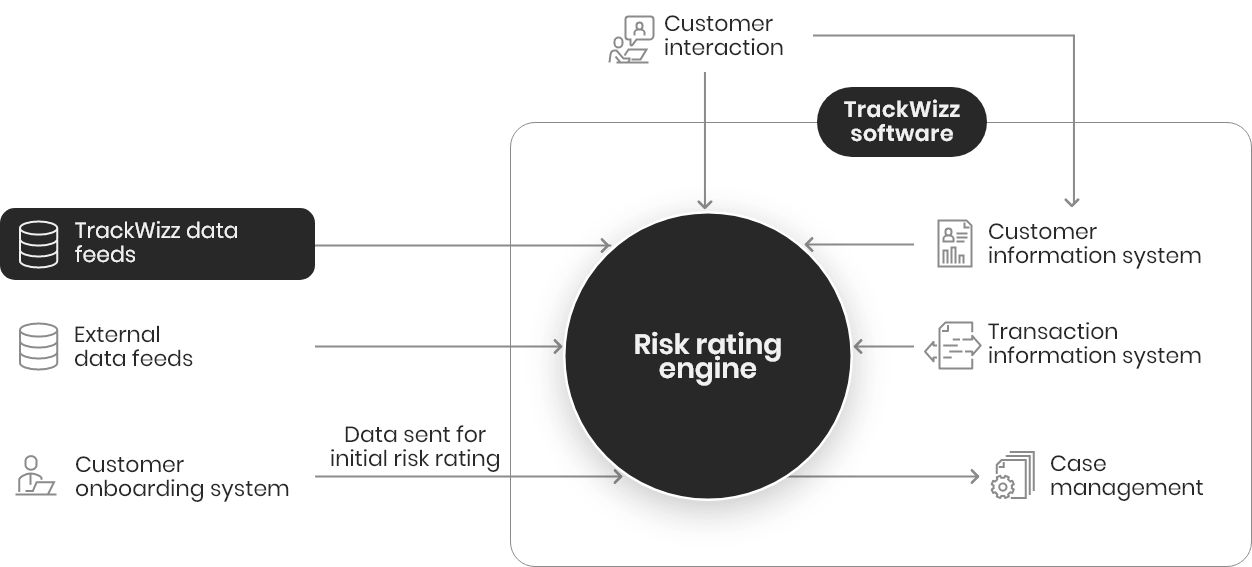

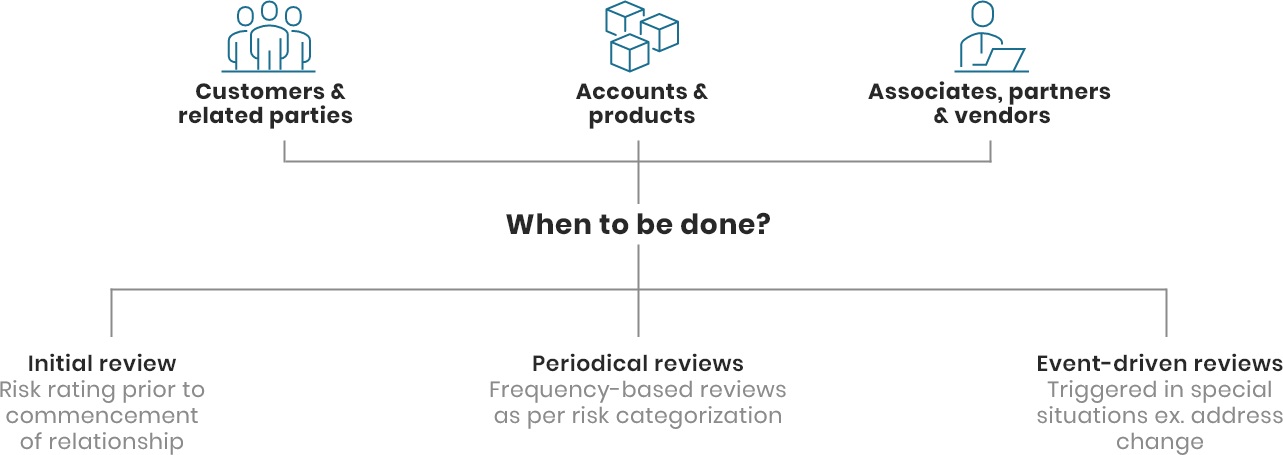

The TrackWizz Risk Rating and Periodical Review solution provides us with the ability to systematically risk rate our clients in accordance with our risk rating methodology. The solution converts a complex set of requirements into a simple and intuitive risk rating process that enables us to focus our energy and resources on those clients that pose a higher money-laundering or terrorist financing risk to our organisation. The solution is the essential component of our risk based approach and smoothly integrates with our solutions ecosystem. In our experience the solution is stable and we are expertly supported by TSS to address any improvement or enhancement requirements. A true game changer if you are dealing with large volumes of clients and have limited resources available.