Madhabi Puri was appointed as a chairperson of the Securities and Exchange Board of India(SEBI) on 28th February. When she was a whole-time member at SEBI, she was cracking down on insider trading and other violations.

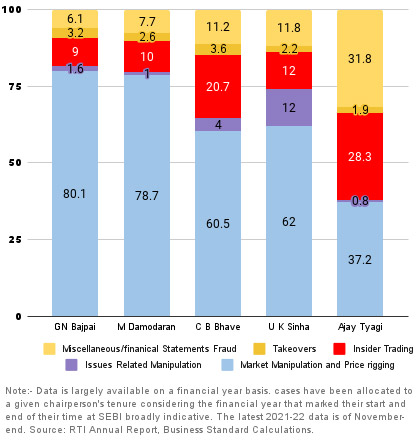

An analysis of key investigations conducted during the tenures of different heads shows marked differences in priorities. Some of this may be driven by existing market conditions and events of the time.

As per the above graph, it can be seen that under G N Bajpai, insider trading cases amounted to 9% of all investigations done by SEBI. During C B Bhave’s tenure, this investigation area grew by up to 20.7 percent. Moving forward in time, during Ajay Tyagi’s tenure, it increased to 28.3 percent.

SEBI began using strong technological tools like Big Data, AI, and ML to keep one step ahead of unethical persons in order to stay one step ahead of them.

The type of investigation SEBI conducted has evolved over time.

Madhabi Puri Buch is noted for using data and technology to improve regulatory technology skills. In the past, the newly appointed chairperson worked on a number of high-profile insider trading cases, a few of which are noted below –

- The Securities and Exchange Board of India (SEBI) has blacklisted 15 entities for exploiting UPSI information and violating PIT requirements in the entertainment insider trading case.

- Social media linkages with well-known oil and gas industries – SEBI’s ruling in the matter of the oil and gas sectors in May 2021 sparked a stir due to the market regulator’s unusual way for establishing a connection between two parties to prove that they had communicated undisclosed price-sensitive information (UPSI).

- Ms.Puri slammed a financial firm in 2018 after learning that a group entity had raised Rs 14,000 crore using voluntary fully convertible debentures, which breached SEBI standards.

As a result, the market can anticipate SEBI to place a greater emphasis on insider trading violations and strengthen the Prohibition of Insider Trading Regulations.

CREDITS: BUSINESS STANDARDS